At Optimum Strategies Group Corp our focus, first and foremost, is on managing risk. Why? Because we see that too many people are taking far too much risk to reach their retirement goals.

MAKING THE RIGHT FINANCIAL DECISIONS TAKES KNOWLEDGE

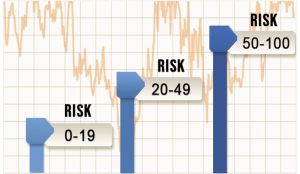

It’s tough to determine which investments to use if you don’t know your own risk tolerance. That’s why we use a program to help clients find their own risk tolerance and to score investments so they match up accordingly.

It’s tough to determine which investments to use if you don’t know your own risk tolerance. That’s why we use a program to help clients find their own risk tolerance and to score investments so they match up accordingly.

WHY CHOOSE US?

Our firm prides itself in our mastermind group which consists of tax attorneys, pension attorneys, CPA’s, Actuaries and insurance experts who specialize in sound tax planning strategies.

Our goal is to be “the” place where small business owners and high net worth individuals can turn to reduce their personal income taxes and grow their wealth.

We hope you enjoy our website and find time to both read various parts of the site as well as watch several of the educational presentations.

MORE INFORMATION

What is Asset Protection?

Most asset protection “gurus” believe asset protection revolves around helping clients who have money protect that money from your “typical” creditor from a negligence suit.

While that’s important, such gurus forget that the #1 creditor clients have every year is the IRS (taxes). Also, people are much more likely to lose money in the stock market in any given year than to be sued for negligence. The goal of a “good” asset protection plan is to make sure “all” of your assets are protected from “all” creditors. This is the specialty of our firm as you will learn when you review our site. To view a brief video presentation on asset protection or to learn more click here.

Predicting The Future

Do you believe the stock market is going to average double-digit returns anytime soon? Do you worry about your money going backwards in a Bear market? Learn More. …

What is the “best” way to grow your wealth for retirement? Is it through tax-deferred tools like 401(k) plans or IRAs? Is it by investing in stocks, mutual funds, index funds, cash value life insurance, annuities, bonds, etc.?

How much risk should you take to reach your financial goals? Our answer is that clients should take the least amount of risk necessary to reach their financial goals (unfortunately most Americans do not take this approach and pay the consequences when the stock market tanks).

This website discusses many unique wealth building tools so readers can educate themselves and make “informed” decisions about the “best” way to grow their wealth.

Protecting Your Wealth From Stock Market Losses With Fixed Indexed Annuities (FIAs)

What you are about to learn will be very exciting to you.

For readers who lost 40%+ when the stock market crashed in 2000-2002 and 40-50-60% when it crashed in 2007-March of 2009, this material will be a real eye opener.

This material covers Fixed Indexed Annuities (FIAs) and why you may want to use them as one of your protective wealth-building/retirement tools.

For more information and to learn how you can use FIAs to protect and grow your wealth, please click here.